On Levered ETFs, Personal Responsibility, and Having Enough Rope With Which To Hang One’s Self

30APR

My boy Felix Salmon has a curious post up this evening, wherein he says anyone who isn’t a (professional?) day-trader should be barred from trading levered ETFs, and that the SEC needs to protect these people (from themselves). I like Felix, but he is seldom (as) off the mark on anything as he is here. His post ignores both existing regulatory practice and the – bear with me here – relatively simple workings of levered ETFs. Allow me to explain…

Levered ETF’s like TBT (which Felix mentions) – or my two favorites, FAS and FAZ – have embedded leverage, that is, they are designed to produce 3x (for FAS/FAZ) the daily return of a basket of stocks/index (or the inverse thereof, in the case of FAZ). The key word here is “daily.” Daily, as in, if the index gains 1% ON THE DAY, the levered ETF will (er, is designed to) return 3%, and the inverse ETF -3%. EACH DAY. Not over-time, EACH. DAY. This is spelled out in extremely plain language in various places, for example, on the Direxion (the sponsor for the ETF) website, under the column “daily target.” The detailed page for each specific ETF, for example FAS, says in the very first paragraph:

Fund Objective

The Financial Bull 3X ETF seeks daily investment results, before fees and expenses, of 300% of the price performance of the Russell 1000® Financial Services Index (“Financial Index”).

This is repeated in several other places, including the fund prospectus, and after it became apparent retail investors had no idea what they were getting in, various additional disclosure from brokerage firms before executing buy orders for these securities. Still, despite the myriad painfully clear explanations of how these securities work, retail “investors” put their capital at-risk without doing even the most basic and cursory “research.” To many of these “investors,” (3x) leveraged ETF’s are somehow supposed to produce the > daily return of the underlying index.

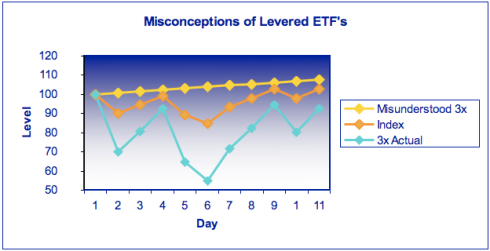

I constructed an example case a few years ago to illustrate what happens here, and how such misunderstanding causes ignorant, naive, and frankly masochistic “investors” to potentially bet the farm on a volatile security they do not understand. Imagine the possible returns for the index are {+-5%, 10%}, arbitrarily assigned over 10 trading days (two calendar weeks). Investors in a levered 3x ETF based upon this index often imagine their returns will look like the yellow-ish line in the below chart, while in reality, they’ll look more like the light blue line.

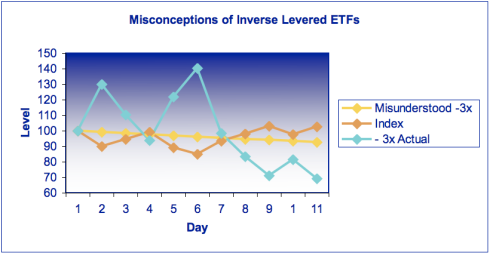

Even though the underlying index has a positive return over the 10-day period (a little over 2.5%), the 3X levered ETF has a negative return, and if the position is sold (by choice, by fed call, it matters not), the “investor” will end up losing money, up to almost half of their initial investment! If investors got into the inverse ETF based upon the same index, with the same daily returns, the yellow-ish line represents what they’d be expecting, while again, the blue line represents what they’d actually see:

Notice how it is entirely possible for both the levered etf and inverse etf to produce negative returns over multi-day holding periods. Remember, this is when the trend over time is a slight uptick in the value of the index with (admittedly) volatile daily returns. When markets move generally in one direction or another – either up or down – it can have profound effects on levered ETF’s because of how they’re designed. In generally rising markets, inverse ETF’s will approach zero over time because subsequent returns are compounded on a lower-and-lower base. In falling markets, bull leveraged ETF’s will exhibit similar behavior.

If we look at FAZ – the 3X inverse financials ETF – over the past two years compared with the Financial Sector Spyder, XLF, when stocks – especially financial ones – experienced a significant rally, we can see that FAZ has decreased in value as we’d expect, with the value approaching zero (i.e. the loss approaching 100%):

As should be extremely obvious at this point, understanding how these ETF’s work is not rocket science, and it does not take much time/effort to do. If you do a quick google search for “how do leveraged etfs work” returns a large number of posts, most of which answer the question with little ambiguity.

Let me put this as nicely as possible: You have to be self-defeatingly ignorant/naive/lazy to trade these things without learning about them. If you have an internet connection, you’d actually have to go out of your way not to pick-up some basic knowledge about how leveraged ETF’s work just by sheer happenstance. The information is EVERYWHERE, easy to find, and just as easy to understand for anyone capable of opening a brokerage account and executing a trade. Additionally, buy orders for these securities require express (at some broker/dealers, from the branch-manager) approval, and must be marked as unsolicited, i.e. brokers cannot sell clients on the idea of buying leveraged ETFs. Clients can only buy them by their own volition, and only after receiving an explicit disclosure warning of the potential to lose a substantial portion of their investment.

According to Felix, though, more and more-stringent regulation is needed:

Given how many people are clearly Doing It Wrong when it comes to TBT, I think there’s a strong case for the SEC to step in here and take a very hard look at TBT in particular, and levered ETFs in general. If day-traders want to day-trade using ETFs, that’s fine — and they can bring their own leverage, if they’re so inclined. But ETFs with embedded leverage are clearly being bought by people who aren’t day-traders at all, and who have no business buying these securities. It’s the SEC’s job to protect those people.It should get on the case.

Let me again put this as nicely as possible:

Bullshit.

Plain and simple. The SEC DOES protect the very people Felix is talking about. That’s why the sponsors of these funds have to disclose how they work in prospectus form, on their website, etc, in language that is so painfully simple even a 5th grader can understand! The SEC can’t (currently) make anyone actually read, let alone understand the material contained therein, nor can they require that broker/dealers make sure such is the case. You know what that is? Because regulations assume that as mature adults, “investors” have enough judgment to be able to read information made available to them, and to use said information to make informed decisions.

Felix’s argument effectively says that because some boisterous, over-confident, naive people choose to dive head-first into the shallow end of the pool before looking down to see the 1-foot-high letters on the edge indicating how deep the water is, we should keep everyone but the Olympic swimmers out of the pool.

Ultimately, the question we must ask ourselves is whether we want regulators to protect us from predatory and unethical behavior from issuers, brokers, and other Wall Street interests seeking to profit from illegal asymmetric information, or do we want them to protect us from our own laziness, naivete, and ineptitude.

If you support the former, then you should dismiss Felix’s argument as itself naive and unrealistic, and enjoy your freedom – but not the obligation – to invest in a variety of securities, using any strategy/approach you deem appropriate for your situation. If the latter, just don’t come whining to me when the only thing in which you’re allowed to invest is a T-bill, causing your assets to grow at a much lower rate, and you’re forced to work until you’re 87 before you can afford to retire.

Aucun commentaire:

Enregistrer un commentaire